News | Retirement Planning | Wealthy Behaviors

New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket

Posted on January 10, 2023

How’s an additional $313,532 sound to you? Sorry, were getting ahead of ourselves…

In November of 2022, the IRS announced a number of changes coming in 2023. Among those changes were new IRA and 401(k) maximum contribution limits. (See the full article linked here, that includes additional details and other important changes to discuss with your advisor.)

Highlights

- The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $22,500, up from $20,500.

- The limit on annual contributions to an IRA increased to $6,500, up from $6,000.

- The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $7,500, up from $6,500.

This is a direct reaction to recent increases in inflation. The increase of $22,500 from $20,500 is a 10% adjustment. We are suggesting that clients increase their savings 10% to all retirement accounts. Let your advisor know if you’d like your retirement savings to increase 10% to match inflation.

So, what do I do with that information?

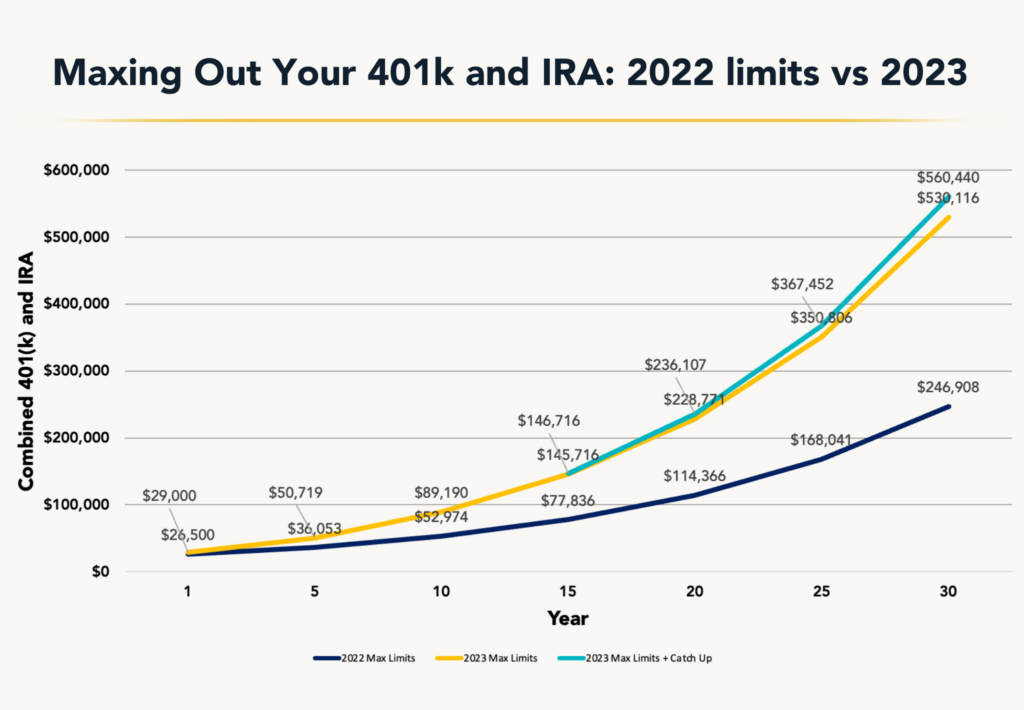

In total, if you were to max out both your IRA and 401(k), you would be investing an additional $2,500 year over year compared to the 2022 limits. (When combined and maxed, you would have been investing $26,500 in 2022, and $29,000 in 2023). Stay with us, this is where the numbers get big!

This may not sound like a huge difference, but we encourage you to think about this long term. Maxing out your IRA and 401(K) to the 2023 limits compared to the 2022 limits (meaning an additional $2,500 dollars invested year over year) for 30 years, growing at a conservative 8%, would result in an additional $283,208!

Let’s take this a step further. Lets say you are an individual who is 35 years old when you begin maxing out your 401(k) and IRA. At age 50, you could take advantage of the catch-up contribution, and invest another $1,000 yearly. Again, assuming a 8% return for the remaining 15 years, that’s an additional $30,324 for a grand total of $560,440. That’s $313,532 more than if you were maxing out based on the 2022 limits.

Talk to your advisor today to make sure you are taking full advantage of these new laws!

*This hypothetical (like any investment, involves a chance of loss) assumes an 8% return throughout the life of the investment, and that the investor is 35 years old at start of investment and takes advantage of catch up contributions at age 50.

Find An Advisor.

Dallas, TX

Visit Office Page >San Diego, CA

Visit Office Page >Colorado

Visit Office Page >250 Fillmore St

suite 150

Denver, CO 80206

United States

Oakmont Financial

Visit Office Page >6580 Oakmont Dr

suite b

Santa Rosa, CA 95409

United States

Advisors

Denver, CO

Visit Office Page >Work Optional

Visit Office Page >3360b Annapolis Ln N

Plymouth, MN 55447

United States

St. Charles

Visit Office Page >1012 1st Capitol Dr

St Charles

Saint Charles, MO 63301

United States

Advisors

Intrua Amarillo

Visit Office Page >5601 I-40

suite 202

Amarillo, TX 79106

United States

Intrua Dallas

Visit Office Page >15660 Dallas Pkwy

suite 860

Dallas, TX 75248

United States

Intrua Wichita Falls

Visit Office Page >2304 Midwestern Pkwy

suite 205

Wichita Falls, TX 76308

United States

T.A. Ohlms

Visit Office Page >2101 Bluestone Dr

Suite 106

Saint Charles, MO 63303

United States

Rochester

Visit Office Page >

Omaha

Visit Office Page >2606 N Main St

suite 100

Omaha, NE 68022

United States

Advisors

Minneapolis North

Visit Office Page >6160 Summit Dr N

Suite 580

Minneapolis, MN 55430

United States

Advisors

Midwest Wealth

Visit Office Page >10475 Crosspoint Blvd

Suite 115

Indianapolis, IN 46256

United States

Advisors

Larson Capital Management

Visit Office Page >14567 N Outer 40 Rd

suite 500

Chesterfield, MO 63017

United States

Advisors

Lakeland

Visit Office Page >65 Lake Morton Dr

Lakeland, FL 33801

United States

Advisors

Kansas City

Visit Office Page >7500 College Blvd

Suite 500

Overland Park, KS 66210

United States

Advisors

Jacksonville

Visit Office Page >10151 Deerwood Park Blvd

building 200 suite 250

Jacksonville, FL 32256

United States

Advisors

Intrua Headquarters

Visit Office Page >3737 Buffalo Speedway

suite 400

Houston, TX 77098

United States

Advisors

St. Louis Headquarters

Visit Office Page >100 N Broadway

suite 1700

St. Louis, MO 63102

United States

Advisors

Great Lakes Regional Headquarters

Visit Office Page >7230 Engle Rd

suite 300

Fort Wayne, IN 46804

United States

Advisors

Fort Wayne

Visit Office Page >4105 W Jefferson Blvd

suite 3

Fort Wayne, IN 46804

United States

Advisors

Durham

Visit Office Page >

Waterloo, IL

Visit Office Page >

Coconut Creek

Visit Office Page >

Chicago

Visit Office Page >233 S Wacker Dr

suite 8400

Chicago, IL 60606

United States

Filter By Office

Explore Industry Headlines

Stay up-to-date on the latest stories affecting the financial sector and your investments.