Disclosures

Larson Capital Management:

Investment advisory services are provided by Larson Capital Management, LLC, an investment advisor registered with the Securities and Exchange Commission.

This website is designed to provide preliminary and general information about the securities and is intended for initial reference purposes only. It does not summarize or compile all the applicable information. This website does not constitute an offer to buy or sell any securities. No offer or sale of any Securities will occur without the delivery of confidential offering materials and related documents. The information contained herein is qualified by and subject to more detailed information in the applicable offering materials. Larson Capital Management, LLC does not make any representation or warranty to any prospective investor regarding the legality of an investment in any offering. These securities are only suitable for accredited investors who understand and are willing and able to accept the high risks associated with private investments.

All securities involve risk and may result in significant losses. Investing in private placements also requires long-term commitments. Investors should have the ability to afford to lose the entire investment and the should have low liquidity needs. Further, alternative investments and private placements should only be a part of your overall investment portfolio and the alternative investment and private placement portion of your portfolio should include a balance of different underlying investment strategies. Before investing you should: (1) conduct your own investigation and analysis; (2) carefully consider the investment and all related charges, expenses, uncertainties, conflicts-of-interest and other risks described in the offering materials; and (3) consult with your own investment, tax, financial and legal advisers.

Past performance is no guarantee of future results. Any financial projections or returns shown on the website are estimated projections of performance only, are hypothetical, are not based on actual investment results and are not guarantees of future results. Target projections do not represent or guarantee the actual results of any transaction, and no representation is made that any transaction will, or is likely to, achieve the results or profits similar to those shown. In addition, other financial metrics and calculations (including amounts of principal and interest repaid) shown on the website or other publicly available mediums have not been independently verified or audited and may differ from the actual financial metrics and calculations for any investment. Private placement investments are not bank deposits and, thus, they are not insured by the FDIC or by any other federal governmental agency. Further, they are not guaranteed by Larson Capital Management, LLC, its affiliates or any other party and they may lose value. Neither the Securities and Exchange Commission (“SEC”) nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through our website or any other medium. Any investment information contained herein has been secured from sources that Larson Capital Management, LLC believe are reliable, but we make not representations or warranties as to the accuracy of such information and accept no liability therefor.

*Accredited Investor Criteria – Risk Factors

No communication by Larson Capital Management, LLC or any of its affiliates through its website or any other publicly available medium, should be construed or intended to be a recommendation to purchase, sell or hold any security or otherwise to be investment, tax, financial , accounting, legal, regulatory or compliance advice. Nothing on our website or any other publicly available medium is intended as an offer to extend credit, an offer to purchase or sell securities or a solicitation of any securities transaction.

Articles or information from third-party media outside this domain may discuss Larson Capital Management, LLC and its affiliates or relate to information contained herein, but Larson Capital Management, LLC does not approve and is not responsible for such content. Hyperlinks to third-party sites, or reproduction of third-party articles, do not constitute an approval or endorsement by Larson Capital Management, LLC of the linked or reproduced content.

Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities and derivatives, using leverage and engaging in short sales. An investment in an alternative investment fund is speculative, and involves substantial risks. An alternative investment fund may be highly leveraged. These funds may not be subject to t he same regulatory requirements as mutual funds, and their fees and expenses may be high.

Real property investments are subject to varying degrees of risk. The yields available from investments in real estate depend on the amount of income and capital appreciation generated by the related properties. Income and real estate values may also be adversely affected by such factors as applicable laws, interest rate levels and the availability of financing. The performance of the economy in each of the regions in which the real estate owned by the Fund is located will impact the income from such properties and their underlying values. The financial results of major local employers also may have an impact on the cash flow and value of certain properties.

Larson Captial Management – Properties (Marketing efforts):

Investment advisory services are provided by Larson Capital Management, LLC, an investment advisor registered with the Securities and Exchange Commission.

All securities involve risk and may result in significant losses. Investing in private placements also requires long-term commitments.

Risks and Limitations- the risks associated with making investment decisions based on targeted metrics is that they are targets. Commercial real estate investing is risky, and that means that the investment will not always play out according to expectations. Targeted returns involved multiple degrees of uncertainty and risk related but not limited to rental rates, lease expiration dates, occupancy rates, length of the investment period, exit cap rates, and interest rates.

Criteria and Assumptions- how a sponsor approaches the underwriting process (conservative, moderate, aggressive) may change the assumptions of the model which include targeted: cash yield, equity multiple, IRR, investment period and distribution rates

For Accredited Investors Only

* According to the SEC, an accredited investor, in the context of a natural person, includes anyone who earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year OR has a net worth over $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence)

Larson Financial Group & Larson Financial Securities:

Advisory Services offered through Larson Financial Group, LLC, a Registered Investment Advisor. Securities offered through Larson Financial Securities, LLC, Member FINRA/SIPC.

Larson Financial Group, LLC, Larson Financial Securities, LLC and their representatives do not provide legal or tax advice or services. Please consult the appropriate professional regarding your legal or tax planning needs.

Larson Tax Partners:

No Rendering of Advice

The information contained within this website is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional accountant.

Presentation of the information via the Internet is not intended to create, and receipt does not constitute, an accountant-client relationship. Internet subscribers, users and online readers are advised not to act upon this information without seeking the service of a professional accountant.

Any U.S. federal tax advice contained in this website is not intended to be used for the purpose of avoiding penalties under U.S. federal tax law.

Accuracy of Information

While we use reasonable efforts to furnish accurate and up-to-date information, we do not warrant that any information contained in or made available through this website is accurate, complete, reliable, current or error-free.

We assume no liability or responsibility for any errors or omissions in the content of this website or such other materials or communications.

Disclaimer of Warranties and Limitations of Liability

This website is provided on an “as is” and “as available” basis. Use of this website is at your own risk. We and our suppliers disclaim all warranties. Neither we nor our suppliers shall be liable for any damages of any kind with the use of this website.

Links to Third Party Websites

For your convenience, this website may contain hyperlinks to websites and servers maintained by third parties. We do not control, evaluate, endorse or guarantee content found in those sites. We do not assume any responsibility or liability for the actions, products, services and content of these sites or the parties that operate them. Your use of such sites is entirely at your own risk.

Larson Financial Holdings:

$4.6B under management

LFH AUM is the total of Larson Financial Group, Larson Capital Managment, Intrua Financial, Inc. AUM source: https://adviserinfo.sec.gov/

Larson Financial Foundation:

LFF is a 501(c) (3) Private Foundation organized in the State of Missouri. Our approved exempted activities include program related investments to establish and support local businesses in emerging markets. These sustainable businesses will impact local economies through job creation and market expansion while enabling LFF to partner within communities in implementing sustainable development initiatives.

LFF contributions

Since the inception of LFF all giving has been self-funded through Paul Larson and starting in 2021 the foundation is now funded through employee contributions and the profits of Larson Financial Holdings.

Regulation Best Interest Disclosure

This guide summarizes important information concerning the scope and terms of the account services offered through Larson Financial Securities, LLC and details the material conflicts of interest that arise through our delivery of our services to you. We encourage you to review this information carefully, along with any applicable account agreement(s) and disclosure documentation you may receive from us or your product sponsors.

As you review this information, we would like to remind you that we are registered with the U.S. Securities and Exchange Commission (SEC) as a Broker Dealer and we are members of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Organization (SIPC). Our Customer Relationship Summary (Form CRS) contains important information about the types of services we offer along with general information related to compensation, conflicts of interest, disciplinary action, and other reportable legal information. Please carefully review and consider the information in each section below.

Account Services

When you establish an account with a product sponsor or insurance carrier through us, the services we provide will vary from product to product. For example, private equity funds do not allow for buying and selling at the client’s discretion post implementation. Thus, we will only help with implementation and ministerial account servicing needs. However, variable insurance products will typically offer a variety of investment subaccounts, which clients are typically allowed to trade in and out of inside the product. 529 College Savings Plans may offer the same trading capability inside the plan. When you utilize these products, our role is to help you implement the product, assist with implementing your investment strategy and assist with ministerial account servicing needs. We do not earn compensation from trading inside these products. As detailed below, our compensation is earned when the products are implemented, and some will offer compensation that is not tied to buying and selling within the product. Please refer to the products prospectus or other offering documents for specific details.

Account Types

Our product sponsors offer many different account types including individual and joint accounts, custodial accounts, estate and trust accounts, partnership accounts, corporate accounts, IRAs, Roth IRAs and other types of retirement accounts.

Incidental Services

It is important for you to understand that when our Registered Representatives make a recommendation to you, we are obligated to ensure the recommendation is in your best interest, considering reasonably available alternatives, and based on your stated investment objective, risk tolerance, liquidity needs, time horizon, financial needs, tax status, and other financial information you provide to your Registered Representative and us. You may accept or reject any recommendation. It is also your responsibility to monitor the investments in your account, and we encourage you to do so regularly. We do not commit to provide on-going monitoring of your account.

Please also consider that from time to time we may provide you with additional information and resources to assist you with managing your account. This may include but is not limited to educational resources, sales and marketing materials, performance reports, asset allocation guidance, and/or periodic account reviews. When we offer these services and information, we do so as a courtesy to you. These activities are not designed to monitor specific investment holdings in your account, they do not contain specific investment recommendations about investment holdings, and you should not consider them a recommendation to trade or hold any particular securities. Upon your request, we will review such information and reports with you and may provide you with investment recommendations, but we are not under a specific obligation to do so.

Understanding Risk

It is important for you to understand that all investment recommendations and activities involve risk, including the risk that you may lose your entire principal. Further, some investments have low liquidity characteristics. Thus, you may not be able to sell out of an investment at your discretion. Higher-risk investments may have the potential for higher returns but also for greater losses. The higher your “risk tolerance,” meaning the amount of risk or loss you are willing and able to accept in order to achieve your investment goals, the more you may decide to invest in higher-risk investments offering the potential for greater returns. Some of the products offered by us do not allow for diversification inside the product as they may have a singular focus. When diversification inside a product is available, we attempt to align risk tolerances with investment needs to offer you different investment objectives from which to choose (see below). You should select the investment objective and risk tolerance best aligned with your account goals and needs.

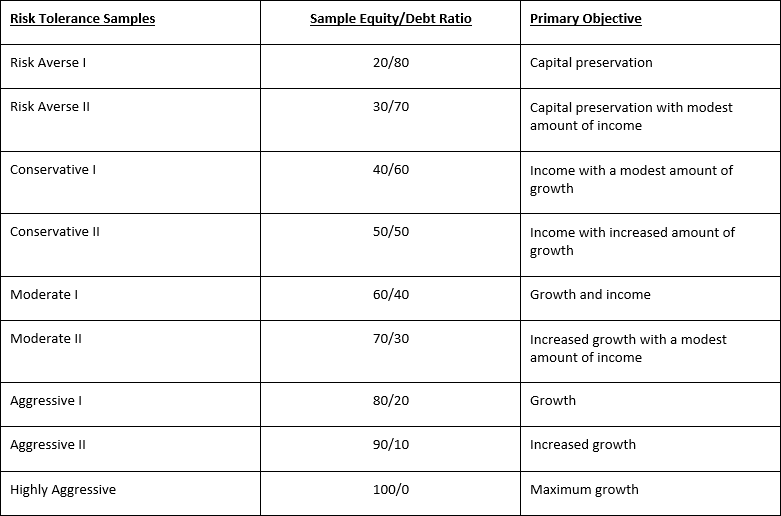

Investment goals typically have different time horizons and different income and growth objectives. Generally, investment goals are on a spectrum, with “Capital Preservation” investors typically holding the smallest percentage of higher- risk investments, followed by “ Income” investors holding some higher-risk investments, followed by “Growth and Income” investors holding more higher risk investments and finally “Growth” investors holding a significant portion of their portfolio in higher-risk investments. Risk tolerance also varies and we measure it on a continuum that increases from “Risk Averse” to “Highly Aggressive”. See the chart below for details.

Account Minimums and Activity Requirements

Account minimums are determined by the product sponsor. Please refer to the product prospectus, or other offering documents for specific details.

Annuities

Annuities are long-term financial products designed for retirement purposes. In essence, annuities are contractual agreements in which payments are made to an insurance company, which agrees to pay out an income or a lump sum amount at a later date. There are contract limitations and fees and charges associated with annuities, administrative fees, and charges for optional benefits. They also may carry early withdrawal penalties and surrender charges and carry additional risks such as the insurance carrier’s ability to pay claims. Moreover, variable annuities carry investment risk similar to mutual funds. Investors should carefully review the terms of the variable annuity contract and prospectus before investing.

Mutual Funds

We currently offer thousands of mutual funds varying in share class structure and investment style. If you invest in mutual funds, we may receive direct and indirect compensation in connection with such mutual fund investments, as described below.

12b-1/Shareholder Service Fees

Annual 12b-1 fees, also known as trails, are paid by the fund and paid to us out of fund assets under a distribution and servicing arrangement to cover distribution expenses and sometimes shareholder service expenses that we may provide on the fund’s behalf. Shareholder servicing fees are paid to respond to investor inquiries and provide investors with information about their investments. These fees are asset-based fees charged by the fund family. These fees range from 0.00% to 1.00%. These fees may be passed on to us and may in turn be passed on to your Registered Representative as a commission.

Front-end Sales Charge Fees/Contingent Deferred Sales Charges (CDSC)

Front-end sales charge fees may be charged and paid to us, including your Registered Representative, when you purchase a fund. The front-end sales charge is deducted from the initial investment on certain share classes. This charge normally ranges from 0.00% to 5.75%. Some purchases may qualify for a reduced front-end sales charge due to breakpoint discounts based on the amount of transaction and rights of accumulation. In addition, some purchases may qualify for a sales charge waiver based on the type of account, and/or certain qualifications within the account. You should contact your Registered Representative if you believe you are eligible for sales charge waivers.

CDSC is a charge you pay upon withdrawal of money from a fund prior to the end of the fund’s CDSC period. CDSC charges range from 0.00% to 5.50%. CDSC periods can range from zero to seven years. This charge typically exists only on share classes that do not have a front-end sales charge. It is sometimes referred to as the back-end load. CDSCs are not charged when you purchase a fund. The fee charged will depend on the share class purchased by the investor. A CDSC is not passed on to your Registered Representative. You can find a description of the amount and payment frequency of all fees and expenses charged and paid by the fund in the fund’s prospectus. Fees and expenses disclosed in the fund’s prospectus are charged against the investment values of the fund.

529 Plans

There are two types of 529 plans—college savings plans and prepaid tuition plans. The college savings version allows earnings to grow tax-deferred and withdrawals are tax-free when used for qualified education expenses. Every state offers at least one of these types of plans. Some states offer both, and a consortium of private colleges also offers a prepaid tuition plan. With college savings plans, students of all ages can save for all college costs, including tuition, fees, room, board, textbooks and computers (if required by the school). Beginning in 2018, 529 Savings Plans can be used to pay for K-12 tuition, up to $10,000 per year per beneficiary. All 529 college savings plans have fees and expenses. Not only do these charges vary among 529 plans, but also, they can vary within a single plan. Like mutual funds, a single college savings plan may offer more than one “class” of shares to investors. Often referred to as A, B or C classes, units or fee structures, each class has different fees and expenses. You can look at the offering document to see if a particular college savings plan offers more than one class.

Here are some of the most common fees, charges and expenses found in college savings plans: Enrollment Fees, Annual Maintenance Fee, Sales Charge (Front-End Sales Load), Deferred Sales Charge, Administration/Management Fee, Underlying Fund Expenses, 12b-1/Shareholder Service Fees.

Alternative Investments

Our current alternative investment offerings are private equity funds, pooled investment vehicles, oil and gas interests, and tax shelters or limited partnerships. Commissions earned by us generally range from 3-5% of the capital invested. Investors within the private equity funds also incur other fees through the Fund’s operation which may reduce profitability and , thus, reduce distribution payouts to investors. These fees include, but are not limited to organizational, tax, legal, audit and fund management fees and fees charged by third-party service providers. These fees are not typically shared with us. However, some of the private equity funds may share a portion of the carried interest earned by the manager with the broker-dealer. Please refer to the fund specific private placement memorandums for more detailed information on fees paid.

Equity Indexed Annuities (EIAs)

EIAs have characteristics of both fixed and variable annuities. Their return varies more than a fixed annuity, but not as much as a variable annuity. So EIAs give you more risk (but more potential return) than a fixed annuity but less risk (and less potential return) than a variable annuity. EIAs offer a minimum guaranteed interest rate combined with an interest rate linked to a market index. Because of the guaranteed interest rate, EIAs have less market risk than variable annuities. EIAs also have the potential to earn returns better than traditional fixed annuities when the stock market is rising. The selling broker is paid a commission for these products; the payout options vary by company, so it’s important to ask your Registered Representative about these charges.

Equity indexed annuities typically do not have an up-front sales charge, but there are often significant surrender fees. Surrender fees are fees that you pay if you withdraw your money before the surrender period ends. Review the product prospectus for this information. Further, because of how the equity indexed annuities are designed, it is important to consider the cost of being tied to the guaranteed interest rate versus investing in products with the potential for higher returns. Surrender fees are solely paid to the insurance company and they are not shared with us.

Insurance Products

We offer variable universal life insurance products. Deciding which insurance product(s) to purchase can be difficult. It is important for clients to work with their registered representative to evaluate how a particular insurance product and its features fit their individual needs and objectives. An important component of any insurance review in the selection process includes carefully reading documents such as the product brochure and sample policy. For variable life products, these documents would include the product prospectus and variable insurance investment subaccount prospectus materials. Each document contains important information that will help clients make an informed decision. Registered representatives will provide these documents for client review and will also answer client questions such as which guarantees are provided by the insurance product, what optional benefits and riders are available, and how variable insurance investment subaccounts are priced.

Similar to Index Annuities, Variable Life insurance products often have significant surrender fees. Surrender fees are fees that you pay if you withdraw your money before the surrender period ends. Review the product prospectus for this information. Surrender fees solely paid to the insurance company and they are not shared with us.

Our Compensation and Conflicts of Interest

Conflicts of interest exist when we provide services to you. A conflict of interest is a situation in which we engage in a transaction or activity where our interest is materially averse to your interest. The mere presence of a conflict of interest does not imply that harm to your interests will occur, but it is important that we acknowledge the presence of conflicts. Moreover, our regulatory obligations require that we establish, maintain, and enforce written policies and procedures reasonably designed to address conflicts of interest associated with our recommendations to you.

Our conflicts of interest are typically the result of compensation structures and other financial arrangements between us, our Registered Representatives, our clients and third parties. We offer a broad range of investment services and products and we receive various forms of compensation our product sponsors and insurance carriers. Securities rules allow for us, our Registered Representatives, and our affiliates to earn compensation when we provide services to you. However, the compensation that we and our Registered Representatives receive varies based upon the product or service you purchase, which creates a financial incentive to recommend investment products and services that generate greater compensation to us. We are committed to taking appropriate steps to identify, mitigate and avoid conflicts of interest to ensure we act in your best interest when providing product recommendations to you. Below you will find additional information related to our conflicts of interest. This information is not intended to be an all-inclusive list of our conflicts, but generally describes those conflicts that are material. In addition to this disclosure, conflicts of interest are disclosed to you in your account agreement(s) and disclosure documents, our product guides and other information we make available to you.

Compensation we receive from clients

Transaction-based conflicts

In most circumstances, when you finalize an investment into a product, we earn a commission which is paid by the product sponsor. In certain circumstances, such as investment in a private placement or an “A” Share mutual fund or “A” Share 529 savings plan, a portion of your investment is deducted as a selling concession and it is paid to us. More details on share classes is provided below. Where these fees apply, the more transactions you enter into, the more compensation that we and your Registered Representative receives. This compensation creates an incentive for us to recommend that you buy rather than sell or hold, these investments. We also have an incentive to recommend that you purchase investment products that carry higher fees, instead of products that carry lower fees or no fees at all.

Compensation we receive from third parties

Third-party payments we receive may be based on new sales of investment products, creating an incentive for us to recommend you buy and sell, rather than hold, investments. Further, we have an incentive to recommend investment products and services that generate greater payments to us. This compensation generally represents an expense embedded in the investment products and services that is borne by investors, even where it is not paid by the Product Sponsor and not directly from the investment product or other fees you pay. The types of third-party compensation we receive include:

Trail Compensation

Ongoing compensation from Product Sponsors may be received by us and shared with our Registered Representatives. This compensation (commonly known as trails, service fees or Rule 12b-1 fees in the case of mutual funds) is typically paid from the assets of the investment product under a distribution or servicing arrangement and is calculated as an annual percentage of invested assets. The amount of this compensation varies from product to product. We have an incentive to recommend that you purchase and hold interests in products that pay us higher trails.

Product Share Classes

Some Product Sponsors offer multiple structures of the same product (e.g., mutual fund share classes) with each option having a unique expense structure, and some having lower costs to you as compared to others. We are incentivized to make available those share classes or other product structures that will generate the highest compensation to us.

The mutual fund industry has developed a multiple share class structure for mutual funds, which provides investors options for paying sales charges and service fees. Though there are several types of share classes, among the most common share classes available to retail investors are Class A, Class B, and Class C. While there is no standard, industry wide definitions of these classes (each mutual fund defines its share classes in its prospectus), some of the typical differences are discussed below. You should note that each class generally has different fees and expenses, and therefore performance results will differ when those fees and expenses are included in a performance presentation. You should also note that the length of time you expect to hold your investment in a mutual fund may play an important role in determining which share class is most appropriate for you, and you should discuss your expectations in this regard with your registered representative.

Class A – This class usually carries a front-end sales charge. This means that a sales charge is deducted from your investment each time you purchase additional shares. Typically, Class A shares have a lower expense ratio (total annual fund operating expenses as a percentage of the mutual fund’s assets) compared to the other share classes of the same mutual fund offered to similar account types, which means that ongoing costs may be lower than the costs associated with other share classes of the same mutual fund. Many mutual funds offer “breakpoint” discounts for large investments within the mutual fund group/family. These breakpoints are described in the mutual fund’s prospectus.

Class B – Rather than imposing a sales charge at the time of initial investment as with Class A shares, Class B shares are characterized by a back-end or contingent deferred sales charges (also known as a “CDSC”), which means that you may pay a sales charge when you redeem (sell) mutual fund shares. The amount of the CDSC as a percentage of your investment normally declines over time and eventually is eliminated the longer you hold your shares (the period of decline may last anywhere from five to eight years depending on the particular mutual fund). Once the CDSC is eliminated, Class B shares usually convert to Class A shares. Until this conversion takes place, Class B shares will generally have higher 12b-1 fees than Class A shares and, as a result, the overall expense ratio for Class B shares will be generally higher than that of Class A shares.

Class C – Class C shares are generally characterized by a level asset-based distribution fee, and, similar to a Class B share, a CDSC. However, unlike Class B shares, the possibility of incurring a CDSC if you sell your shares generally goes away after a short period of time (usually one year). Class C shares may have the same 12b-1 fees as Class A and B shares, but the level asset-based sales charge will increase the ongoing asset-based fees of the fund. As a result, Class C shares will almost always have a higher total operating expense ratio than Class A shares.

Further explanation of mutual fund share classes and their related fees is available on the Financial Industry Regulatory Authority’s website at www.finra.org (click on the “ Investors ” tab).

Compensation Related To Proprietary Products

Our recommendations can include a recommendation to invest in a product or service that is managed, issued or sponsored by us or our affiliates. We and our affiliates will receive additional compensation or economic benefits from investments by you in such products, including, but not limited to, management fees and service-related fees. Please refer to the product prospectus or other offering document for specific details. The compensation related to these may be greater than similar products provided by third parties. Thus, we have an incentive to recommend investments in proprietary/affiliated products.

Compensation Received By

Registered Representatives are compensated with commissions, paid to the firm and provided by the product sponsor. This compensation may vary by the product. In addition to upfront-transaction based compensation, some products feature on-going residual or “trail” payments. Thus, Registered Representatives are incentivized to recommend products that have higher fees as well as those with on-going payments.

Typically, a Registered Representative’s payout schedule (periodically adjusted by us at our discretion) increases with production and asset levels. The same payout schedule is reduced when Registered Representatives discount certain client fees and commissions. As a result, Registered Representatives have an incentive to provide recommendations that result in selling more investment products and services, as well as investment products and services that carry higher fees.

Registered Representatives have an incentive to recommend you rollover assets from a Qualified Retirement Plan (QRP) to an Individual Retirement Account (IRA) through our product sponsors because of the compensation they will receive. We maintain policies and procedures designed to ensure that rollover recommendations are in your best interest.

Other Activities

Registered Representatives may be motivated to place trades ahead of clients in order to receive more favorable prices than their clients.

Registered Representatives who are transitioning through a succession plan may be incentivized to make brokerage recommendations designed to increase the value of their “book of business” through asset accumulation or brokerage trades that are not in your best interest. Registered Representatives who receive clients from a retiring Registered Representative are incentivized to meet growth goals and may make recommendations not in your best interest.

Customer Relationship Summary (“Form CRS”)

Updated Privacy Notice: click here.