Weekly Market Commentary

Trade Talks Boost Markets, Oil Surges on Mideast Tensions

Posted on June 17, 2025

Trade Talks Boost Markets, Oil Surges on Mideast Tensions

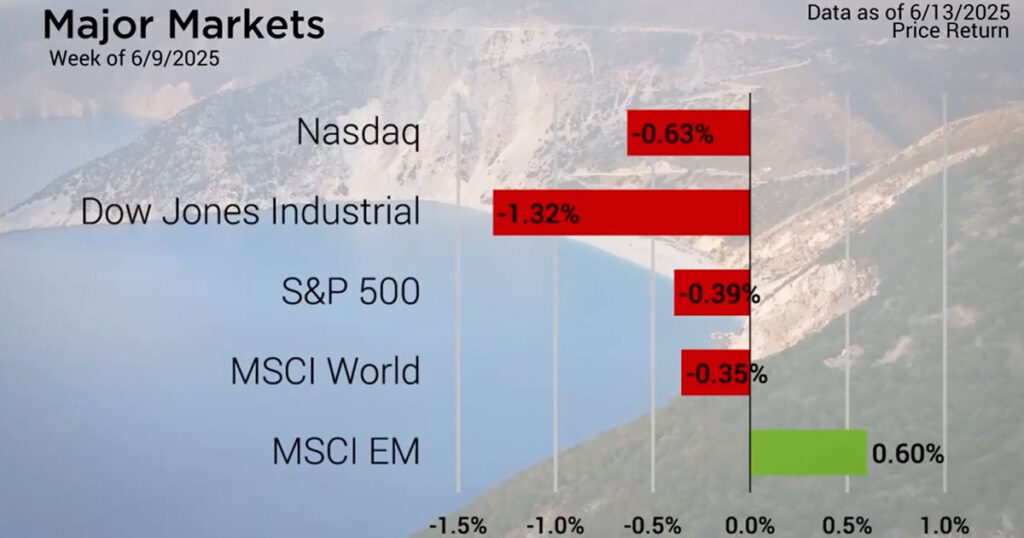

The Major Markets closed mostly lower last week. The week was punctuated by Geopolitical events across the globe. The week opened with optimism around the resolution to US China Trade relations. The news at the start of the week was that China and the US had effectively walked back the escalation in tariffs to a 50% and 10% level. This is more in line with things stood back in April before the two countries began aggressively increasing tariffs following the April 2nd “Liberation Day” announcements.

Additional progress was made in talks with India , Mexico , and Canada . However, the administration is still a ways away from the goal of completing 90 deals in 90 days.

Meanwhile, tensions escalated between Israel and Iran last week as the middle east once again made headlines. This turmoil caused energy prices to spike.

Major Markets |

YTD as of 06/13/2025 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Crude Oil prices surged higher with the S&P GSCI Crude Oil Index adding 12.43% for the week. This fueled the gains in energy, which while not the only sector in positive territory, was the top performing sector for the week, adding five- and three-quarter percentage points.

Finally, Treasury prices fell. The yield curve dropped by up to 12 basis points in the three-year duration. This caused bond indices to rise. The Bloomberg Barclays Aggregate Bond Index added 2/3s of a percent as a result for the week.

https://www.reuters.com/world/china/us-china-trade-talks-resume-second-day-2025-06-10

High earner? Learn how a backdoor Roth IRA can help maximize your retirement savings—even if you face income limits.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |