News

The One Big Beautiful Bill

Posted on July 24, 2025

What it Means for You

And Why Planning Now Matters

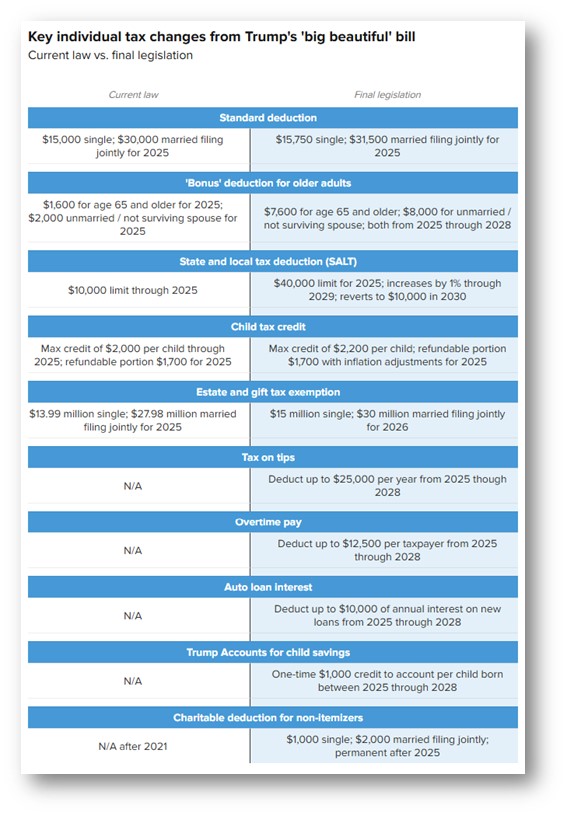

July 4, 2025, marked more than just this year’s Independence Day: it ushered in the largest overhaul of the U.S. tax code in nearly a decade. The “One Big Beautiful Bill” (OBBB) has been signed into law, and while headlines focus on its political implications, the real question is: What does this mean for you?

From expanded estate exemptions and tax-free tips to new savings vehicles for kids, this nearly 900-page law touches almost every corner of the financial planning landscape. At Larson, we believe this kind of sweeping change is best met with thoughtful strategy and proactive planning. Below, we break down the key changes that could affect you, and how your Larson advisor can help turn complexity into clarity.

Key Tax Updates That Matter to You

The OBBB permanently enshrines many of the tax reforms from the 2017 Tax Cuts and Jobs Act. These changes help create new certainty in the tax landscape that allows for proactive, long-term planning. High-net-worth families, retirees, and earners in high-tax states will see both opportunities and challenges depending on their financial picture. Strategic timing and coordination with your advisor will be critical for optimizing outcomes.

Permanent Tax Rate Cuts, Including the Top Bracket

The tax rate structure introduced in 2017 is now permanent.[i] That includes the 37% top bracket, the higher standard deduction, and the rollback of the Alternative Minimum Tax (AMT) for most filers.

What this means for you: You can now plan with confidence around tax brackets, Roth conversions, and retirement distributions. Larson advisors can help model long-term tax strategies that optimize lifetime tax liability.

Estate & Gift Tax Exemption Expanded (Again)

The estate tax exemption is now set at $15 million per person (or $30 million per couple), indexed for inflation and made permanent.[ii]

Why it matters: This opens the door for ultra-high-net-worth families to make strategic moves like funding trusts or initiating large gifts before any future political shifts. It’s an ideal time to revisit dynasty planning.

Higher Standard Deductions and New Senior Benefit

Starting in 2025, the standard deduction increases to $31,500 for joint filers, with an extra $6,000 for those age 65+ (subject to income phaseouts).

Action step: If you’re nearing retirement, this could impact your income distribution plan. Larson can help you evaluate the tax efficiency of your withdrawals, especially around the senior deduction cliff.

SALT Deduction Raised…but With Caveats

The cap on state and local tax (SALT) deductions quadruples to $40,000, but phases out between $500,000 and $600,000 of adjusted gross income (AGI).[iii] Joint filers don’t get a higher cap.

Our guidance: High earners in high-tax states should revisit income-splitting, tax timing, and filing strategies. Your Larson advisor can help you navigate this “danger zone.”

For Business Owners and Investors

The OBBB retools key business incentives to encourage capital investment and reward long-term entrepreneurship. From bonus depreciation to expanded QSBS exclusions, these provisions offer meaningful savings potential…but only for those who plan ahead. Structuring entity types, timing asset purchases, and coordinating exits will now take on increased importance.

100% Bonus Depreciation Reinstated

Starting January 20, 2025, businesses can now fully expense qualifying capital investments again. Section 179 deductions rise to $2.5 million, phasing out at $4 million.[iv]

Why this is big: Business owners can immediately deduct large purchases. This makes it a good time to revisit acquisition timelines and cost segregation studies with your advisor.

Qualified Business Income (QBI) Deduction Made Permanent

Pass-through entities retain their 20% deduction.[v] While phaseouts still apply to certain professionals, the certainty allows for better planning.

New QSBS Rules Expand Exit Flexibility

The capital gains exclusion for Qualified Small Business Stock is now tiered based on holding period: 50% after 3 years, 75% after 4, and 100% after 5. The exclusion cap increases to $15 million.

Planning tip: Talk to your advisor about non-grantor trusts, Section 1045 rollovers, and family gifting strategies that may help you maximize this new flexibility.

New Opportunities for Families and Savers

Families and savers are among the biggest beneficiaries of this legislation. Expanded flexibility in education accounts and the introduction of child-focused savings vehicles reflect a push to encourage multigenerational wealth planning. These tools can support everything from homeschooling to long-term investment growth for children.

529 Plans Just Got a Lot More Versatile

Qualified expenses now include homeschooling, tutoring, books, dual enrollment tuition, testing fees, and professional certifications (e.g., CPA, CFP prep).

Planning ahead: If you have a growing family or want to support education beyond college, a 529 may be more flexible than ever. Your Larson advisor can help evaluate whether you’re funding these accounts efficiently.

Introducing “Trump Accounts” for Children

Families can now contribute up to $5,000/year per child into these tax-advantaged accounts. Employers can add $2,500, and an IRS pilot program adds $1,000 for children born between 2025 – 2028.

How to use it: These accounts function like Roth IRAs, which can be good for long-term savings and wealth transfer conversations. Let us help you incorporate these into your broader legacy plan.

Additional Tax Breaks to Note

The OBBB includes several niche but impactful tax breaks that can benefit individuals across income levels, particularly working-class families, charitable donors, and car buyers. While some of these provisions are temporary or phased out at higher incomes, they may offer meaningful tax savings in the near term.

- Tax-Free Tips & Overtime: Service workers will no longer pay income tax on tip income through 2028. Up to $25,000 of tips and $12,500 of overtime can be deducted annually.

- Vehicle Loan Interest: Up to $10,000/year in interest on new or used car loans is deductible (phased out for high earners).

- Non-Itemizer Charitable Giving: You can now deduct up to $2,000 in charitable giving even if you take the standard deduction.

Why This All Matters Now

The One Big Beautiful Bill isn’t just another tax law: it’s a planning catalyst. With dozens of changes and a mix of permanent and sunset provisions, this legislation creates both clarity and urgency. For many, the next 6 to 18 months will be a critical period to reevaluate strategies, realign goals, and lock in available benefits.

The most successful outcomes won’t come from reacting later; they’ll come from planning today. Whether it’s revisiting estate plans, optimizing tax brackets, analyzing your charitable giving, or upgrading your business structure, this is the moment to take decisive, informed action.

At Larson, our role is to transform legislation into opportunity. We help you filter out the noise, prioritize what matters, and build a plan that adapts with confidence.

Tax policy may be written in Washington, but the impact is written in your financial plan. Let’s make sure yours is ready. Connect with your Larson advisor today.

[i] https://uswealth.bmo.com/insights/breaking-down-the-impacts-of-the-one-big-beautiful-bill

[ii] https://lslcpas.com/one-big-beautiful-bill-act-obbba-for-businesses-high-net-worth-individuals/

[iii] https://www.kiplinger.com/retirement/retirement-planning/how-wealthy-retirees-can-benefit-from-the-big-beautiful-bill

[iv] https://taxfoundation.org/research/all/federal/big-beautiful-bill-senate-gop-tax-plan/

[v] https://www.cohenco.com/knowledge-center/insights/july-2025/one-big-beautiful-bill-up-close-tax-impact-for-high-net-worth-individuals

[vi] https://www.cnbc.com/2025/07/03/trump-big-beautiful-bill-tax-changes.html