Weekly Market Commentary

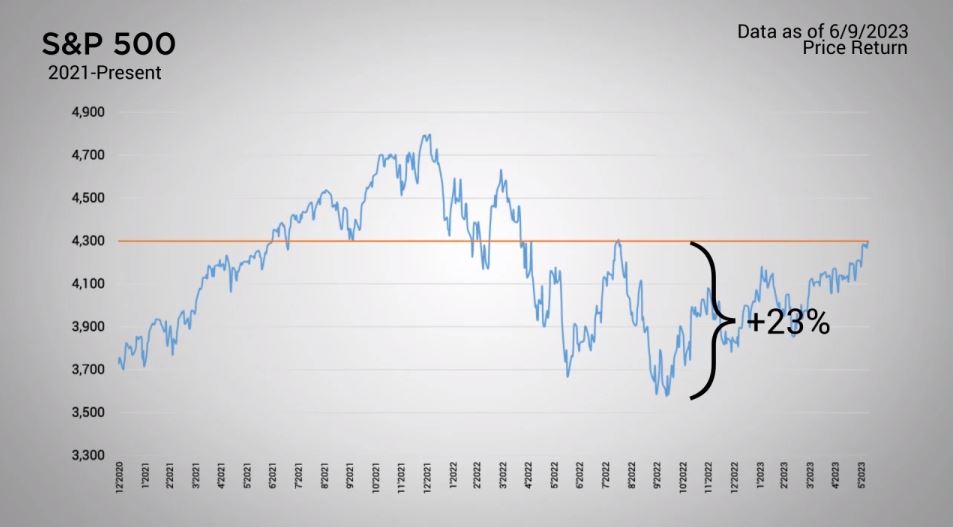

S&P 500 Crosses the 4,300 Level

Posted on June 12, 2023

Market Commentary by Mitchell Wood, Larson COO

| The Major Markets closed higher across the board last week. For the S&P 500, the big news was that the S&P 500 crossed over the 4,300 level after flirting with the threshold the last couple weeks. Moreover, the cumulative gains since the Q4 lows exceeded 20 percent, effectively taking the Blue-Chip index back into bull market territory. |

| Additionally, the 39-basis point weekly gain marked the fourth consecutive week of positive performance. Digging deeper into the domestic market, the weekly gains in the large cap space was significantly outpaced by the Small Cap Segment. Value beat Growth, and Small Cap Value was the clear winner last week as the index added nearly one and three quarters percent return for the week. |

Concerns about economic growth were visible following the results from a number of economic reports.

| Monday’s Services PMI came in weaker than expected with a reading of 54.9, below the prior reading of 55.1. Additionally, Factory Orders missed expectations of 0.6 percent with a headline 0.4 percent increase. Finally, Monday also had the ISM Services Index which had been expected to increase month-over-month but came in just above the expansion/contraction threshold at 50. For treasuries, the yield curve flattened ever-so-slightly as the shorter end of the yield curve dropped a few points while the intermediate to longer-term durations rose. This caused the bond market to see losses in the higher quality bonds. This week, market participants will be transfixed on the FOMC Meeting midweek. While the overall market consensus is that the Fed will hold the Fed Funds rate steady at this meeting (after 10 consecutive meetings of rate increases), analysts will be listening intently for direction from the committee during the post meeting press conference. https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/ |

Want to talk more about market activity?

Click “Schedule a Consult” to set up an appointment with your advisor.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |