Weekly Market Commentary

Orders from Boeing Almost Completely Disappeared for a Month

Posted on March 12, 2024

The Major Markets closed the week mixed with the weekly returns stair-stepping higher with each subsequent index.

The inconsistency in returns was also apparent in the style boxes. Generally, Value appeared to do better than Growth, yet the Mid-Cap segment outperformed both Large and Small Capitalizations.

The week was marked by a number of noteworthy economic reports.

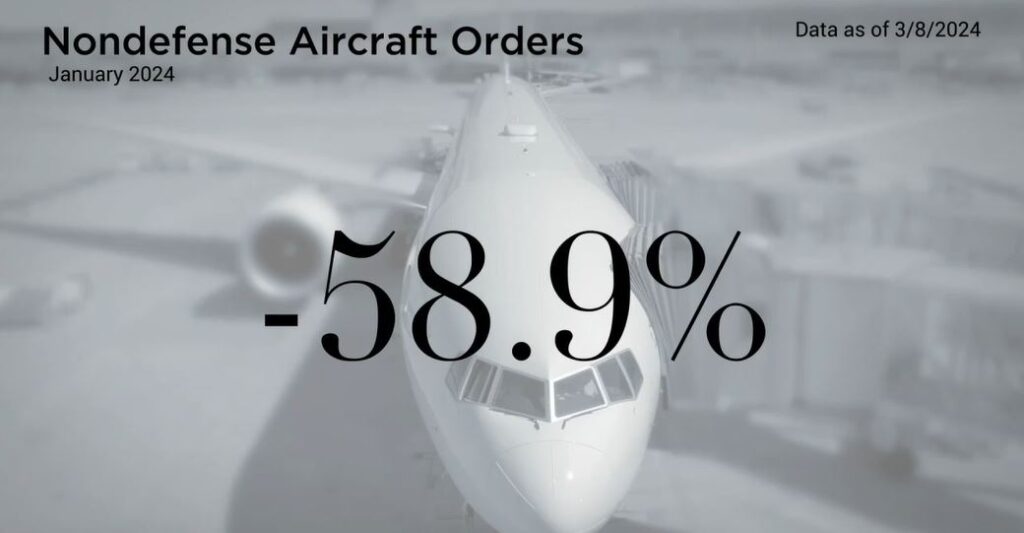

Tuesday held the first economic release with misses in Factory Orders and the ISM Services results. Factory Orders dropped 3.6 percent in January with Boeing serving as a significant factor in the results. Nondefense or Commercial aircraft orders collapsed 58.9 percent in January. After Boeing made headlines in January following a blowout of an emergency door on a Boeing 737 Max, orders from the manufacturer almost completely disappeared for the month.

Publicity around Boeing further soured when it was reported that there had been a spike in the filtering of specific aircraft models on the travel site Kayak which allows travelers to include or exclude specific models of aircraft.

ISM Services news also missed expectations with a headline reading of 52.6 percent, compared to the 53.0 percent expected and the 53.4 percent from the prior month.

Major Markets |

YTD as of 03/08/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

These reports weighed on the minds of investors as Tuesday experienced the largest drop for the week. As the week wore on, the S&P 500 managed to generate gains midweek. Thursday was punctuated by the testimony of Federal Reserve Chairman Jerome Powell in front of Congress. In his comments, Powell said:

“We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our two percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to two percent.”

This reserved prognosis of interest rates did little to stimulate the market more than the prior economic and earnings results from the week. Nonetheless, interest rates fell largely across the yield curve with 12 basis points being shed in the 7-year duration.

https://finance.yahoo.com/news/us-factory-orders-fall-more-154319064.html

https://www.federalreserve.gov/newsevents/testimony/powell20240306a.htm

It’s tax season, and each year scammers try to take advantage of unsuspecting individuals. Check out our report on protecting your wealth.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |