Weekly Market Commentary

Markets Ended Mixed but Overall Lower

Posted on May 15, 2023

Market Commentary by Mitchell Wood, Larson COO

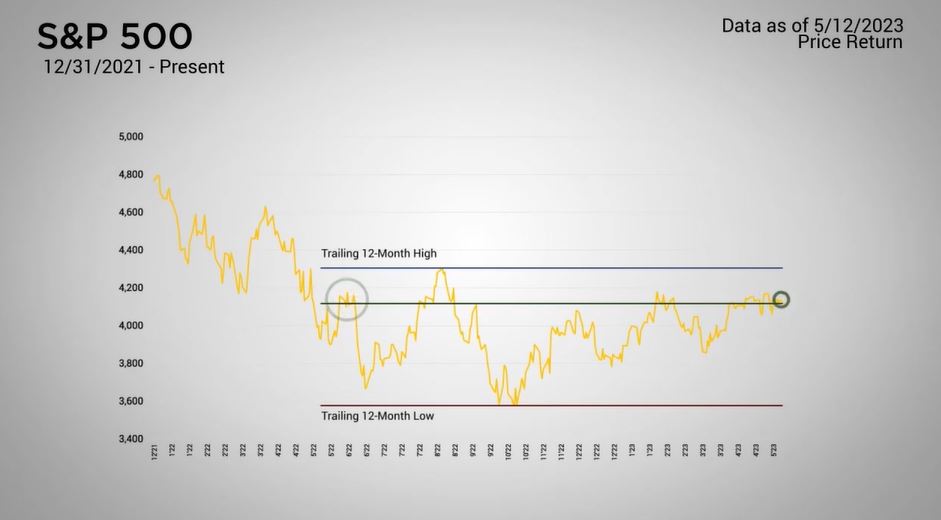

| The Major Markets ended the week mixed but overall, mostly lower. The Nasdaq was the lone holdout in positive territory while the Dow Jones Industrial Average closed over a percentage point lower. For the S&P 500, the roughly third percentage point loss is the second consecutive loss after six weeks of alternating positive and negative returns. From a technical perspective, the last couple of weeks have seen the S&P 500 stall out at the mid 4,100 level. This level happens to be the high from May and June of last year. Over the last year, the S&P 500 has traded in a 700-point range that spanned the peak of last August with the lows of last October. However, the bulk of the last 12 months has seen the trading days taking place within the 1st standard deviation range between 3,810 and 4,117. Last week, the S&P 500 struggled to break above this average for the first time since January of 2022. |

On the economic front, last Wednesday saw the release of the Consumer Price Index.

| The April year-over-year Consumer Price Index reading came in lower than expected and below the 5.0 threshold for the first time in two years. This event helped to stimulate the markets as the S&P 500 logged its most significant gain for the week. This favorable reading was echoed Thursday when the Producer Price Index also came in cooler than expected and saw a 2.3 percent year over year increase, below the prior 2.7 percent reading. However, the overall optimism from the prior day waned as the week came to a close. This week represents the tail end of the earnings calendar as over 90 percent of the companies have already reported. As FactSet noted, 78 percent of these companies reported actual earnings per share above the mean EPS estimate. Furthermore, this is also the highest percentage of companies reporting a positive EPS surprise since Q3 of 2021. Looking ahead, market analysts will likely become more fixated on the debt ceiling debate and the turmoil in Washington. https://insight.factset.com/sp-500-companies-reporting-positive-eps-surprises-for-q1-see-below-average-price-increases |

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |