Weekly Market Commentary

The Major Markets Closed Mixed Last Week

Posted on July 24, 2023

Market Commentary by Mitchell Wood, Larson COO

| The Major Markets closed mixed last week. In a bit of a change of pace, the Dow Jones Industrial Average led the pack with an impressive 2 percentage point gain. Possibly even more impressive was the fact that Friday’s ever so slight 0.01 percent daily return was enough to give the index its 10th consecutive daily gain. That said, the weekly gain in the Dow Jones only helped it slightly break beyond last place of the Major Markets year to date. Meanwhile, the roughly half percentage point loss barely reduced the Nasdaq’s impressive 30 percent plus year-to-date gains. Breaking the S&P 500 down by sector, a similar pattern emerged. The more technology-positioned sectors saw the greatest losses with Communication Services and Consumer Discretionary seeing the greatest pullbacks, while the IT space ended the week relatively flat. |

| Some market analysts attributed the pullback to general profit taking ahead of the more significant quarterly earnings releases or uncertainty in companies’ forward-looking guidance. Even a favorable surprise in the earnings per share results was not enough to guarantee a positive return in market performance. |

Two of the largest examples of this last week were Netflix and Tesla.

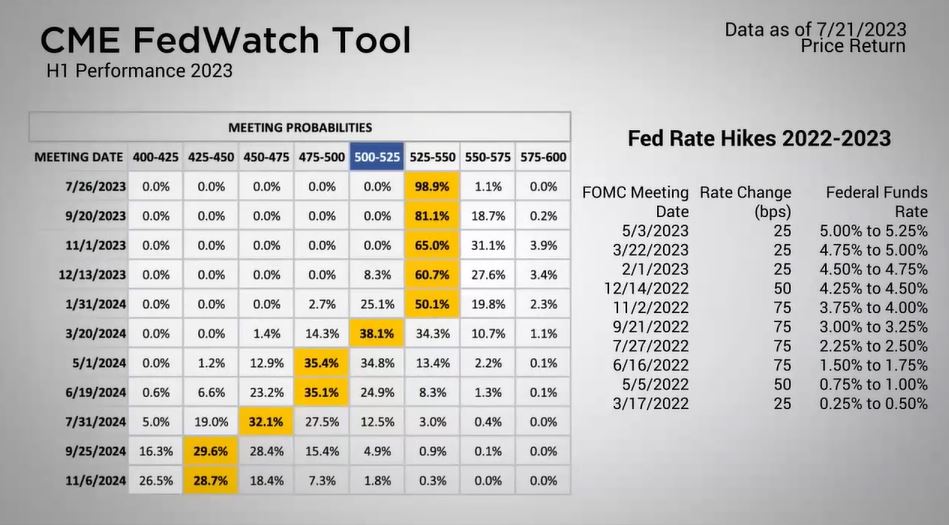

| These two companies both saw significant beats in their earnings per share relative to estimates, however their share prices ultimately fell based upon guidance. Forward-looking guidance will continue to be a dominant theme as more companies continue to report. This week will see a significant ramp up in the number of companies reporting with the peak being next week. This week also holds the July FOMC Meeting. Market participants anticipate that the FOMC will raise the Fed Funds rate one more time to the 525-550 basis point level. As it stands today, the CME Group projects the greater probability that this will serve as the peak in the Fed Funds rate. That said, the final meetings for the year in Q4 have a significant possibility of another 25-basis point increase, depending on how the economy and inflation continues to develop. |

Time to your financial review?

Click “Schedule a Consult” to set up an appointment with your advisor.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |