Weekly Market Commentary

Inflation Fears Shake Markets

Posted on April 17, 2024

The Major Markets extended the losses for the quarter as all five indices closed lower. The Dow Jones experienced the largest pullback for the second week in a row.

Not one sector provided optimism. Information Technology was only able to show a slight loss for the week. Yet, Financials, Health Care, Materials and Real Estate all experienced losses that exceeded three percent.

The week began with hotter than expected CPI results. The BLS reported a 0.4% increase in March. This matched February’s results but failed to deliver the reduction in the inflation rate that market analysts were hoping for. Moreover, the year-over-year number actually saw an uptick from February’s 3.2% to 3.5% in March.

Core Inflation, which excludes food and energy, came in even hotter with a result of 3.8% year-over-year.

These numbers took the rate-cut optimism out of the market fairly quickly. The CME Group FedWatch tool saw expectations of a 25-basis point rate cut drop from a 50.8% probability to only a 21.6% possibility as of Friday. Furthermore, the odds of additional rate cuts became even less likely. The first significant probability of interest rates standing 50-basis lower than the present range have been pushed all the way to the final FOMC Meeting of the year.

Major Markets |

YTD as of 04/12/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

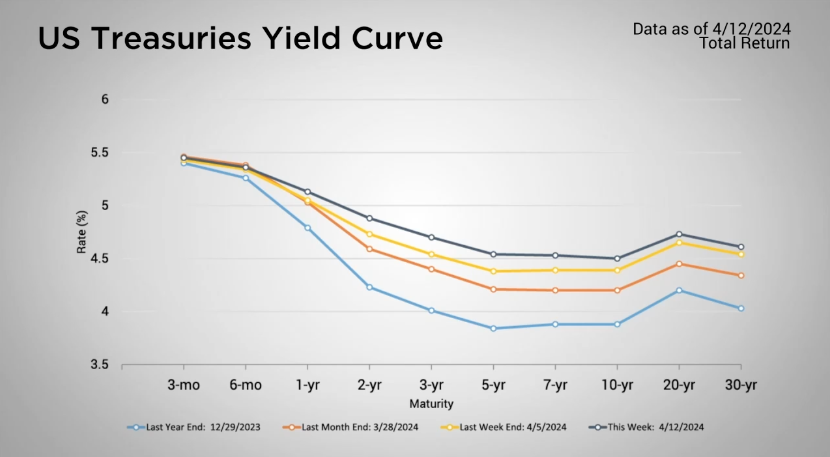

This in turn caused the longer end of the yield curve to climb higher. The greatest increases were in the intermediate durations of the curve which saw the yield rise 16 basis points.

The rise in interest rates caused bonds to fall again. The Bloomberg Barclays Aggregate Bond Index gave back nearly ¾ of a percent, taking the year-to-date losses to just over 2.5% for the year.

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |